Trading Algorithms using Python

Being technical at heart, I was looking for a way to level up my trading skills and to gain an "edge" in the market. I discovered Quantopian which is a website that allows you create trading algorithms to test your ideas with historical data. Below is a trading algorithm I am working on. I plan to use the RSI indicator in conjunction with other indicators. Outside of Quantopian I pull in and analyze financial data from Yahoo to alert myself via email/SMS when signals are in line.

RSI EWMA Mean Crossover

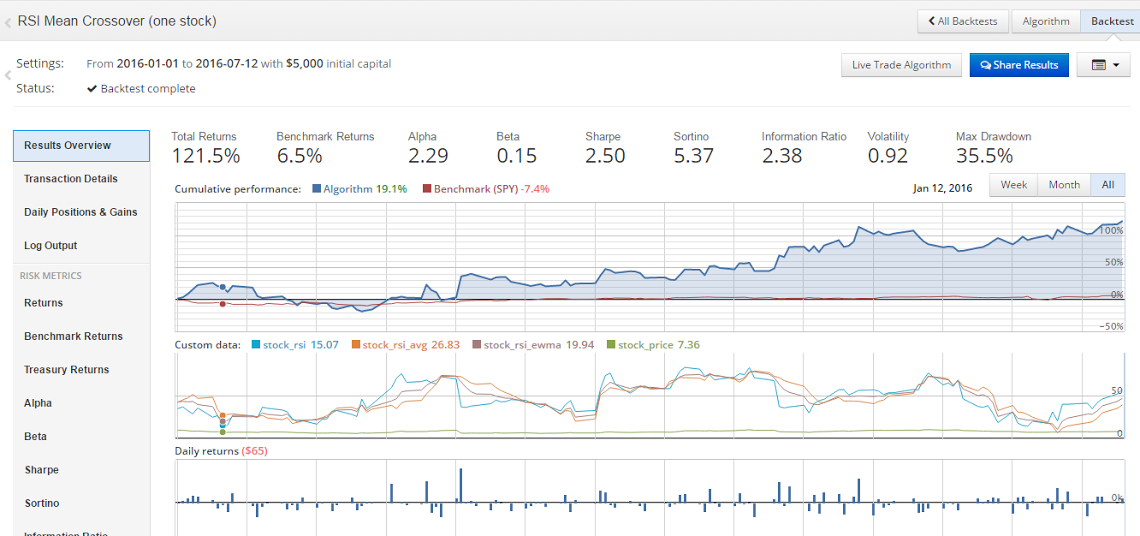

This algorithm calculates the Relative Strength Index (RSI) for one stock over a specified window length. The weighted mean (exponential moving average) is calculated. The weighted mean is compared with the actual RSI value of the stock to determine when a RSI crossover occurs. Results for $RMTI can be seen below. Other stocks are currently being tested.

Year to Date Backtest on $RMTI using RSI Mean Crossover Algorithm; 121.5% YTD return vs. 6.5% for $SPY

Outside of Quantopian

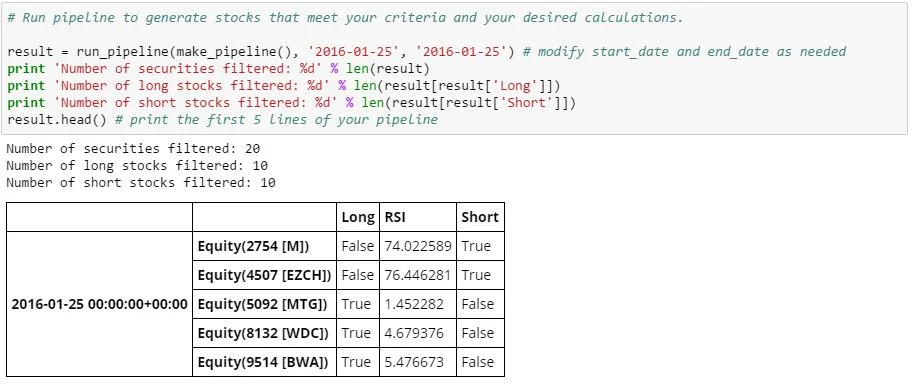

By developing my own Python scripts revolving around the backtest results on Quantopian, I stay up-to-date with stock alerts that are sent to myself and colleagues via email, or SMS. The scripts I have created screen the entire list of equities in the US markets based on criteria I have successfully backtested. Below are a few plots of the stocks I have analyzed.

Please take a moment to view my GitHub repository below.