Not the most traditional path to take in trading. However, if you’re someone that wants to pursue a career as a day trader, but are limited on time, or don’t have a lot of capital (less than $5,000) to start with then futures trading is a great fit for you. Of course trading futures can be riskier then trading stocks due to leverage from low margin requirements. But that’s why risk management should be your number one focus.

But what in life that’s worth it isn’t risky? Seriously.

I always say if you know how to trade futures successfully, you can trade anything else even options. The futures market is the only way to get a pulse on what’s happening from a global context, which in and of itself will give you an edge.

Without further or due, here is how you can get started trading futures!

Trading is 90% Mental

If you’re looking to make a quick buck, get rich overnight, or just want to dabble for fun then stop right here. Trading is a skill, more like an art, that takes years to become proficient at. You have to be in it for the long haul. Trading is 90% mental so ask yourself these 10 questions to see if you have and are willing to develop what it takes to become successful at trading futures:

Am I willing to risk my hard earned money with the high possibility I could lose some or all of it during the learning process?

How do I deal with failure/losing? Do I accept it as a learning experience and keep pushing forward, or do I get upset/angry/frustrated?

Do I know myself well enough to always keep my best interests at the forefront at all times?

How do I manage my own finances? Do I save at least 20% of my income each month or do I find myself barely getting by because I spend money before I have it?

Do I have patience to slowly build an account according to a predefined risk management plan?

Am I disciplined, i.e. can I follow a strict set of rules in a world that has no rules?

Am I happy with my life and free from any major stress on a day to day basis?

Can I make split second decisions and great judgement calls in a dynamic environment?

Can I be consistent and persistent in learning how to trade despite any setbacks I encounter?

Do I have an abundance mindset, or do I think opportunities in the market are limited?

“Trading is 90% mental.”

I’m sure I could come up with 100 more questions you need to ask yourself before you open a brokerage account or a single chart, but this will get you started. Knowing yourself is the #1 way to avoid common pitfalls in trading.

I will be covering trading psychology in another blog post in the near future.

Be honest and take your time. Trading profitably can take 12-18 months or more, but remember you should always be learning and improving.

Next your journey through the futures marketplace begins.

Start Getting in Tune with the Marketplace

How Futures Work

A derivative is simply any financial instrument that "derives" (hence the name) its value from the price movement of another instrument. In other words, the price of the derivative is not a function of any inherent value, but rather of changes in the value of whatever instrument the derivative tracks. For example, the value of a derivative linked to the S&P 500 is a function of price movements in the S&P 500. One type of derivative is a futures contract.

A futures contract, similar to an options contract, is an agreement between two parties to buy or sell an asset at a specified future date and price. Each futures contract is specific to the underlying commodity or financial instrument and expiration date. Prices for each contract fluctuate throughout the trading session in response to economic events and market activity.

Futures Markets by Category

“Prices for each contract fluctuate throughout the trading session in response to economic events and market activity.”

Contract Expiration

All futures contracts have specific expiration dates. If you don’t exit your position before that date you have to deliver the physical commodity (if you’re in a short position) or take delivery (if you’re long). So if you bought a light sweet crude oil futures contract and held through expiration, you will be required to purchase 1,000 barrels at the contract price, i.e. closing price is $63.00 per barrel, you have to pay $63,000 per contract. Some futures contracts call for physical delivery of the asset, while others are settled in cash.

Note that the nearer the contract expiration, the greater the trading volume – and the further out the contract, the higher the price.

As a futures trader you DO NOT HOLD THROUGH EXPIRY. In general, most investors and day traders trade futures contracts to hedge risk and speculate, not to exchange physical commodities. Nearly all futures contracts are cash settled and end without the actual physical delivery of any commodity.

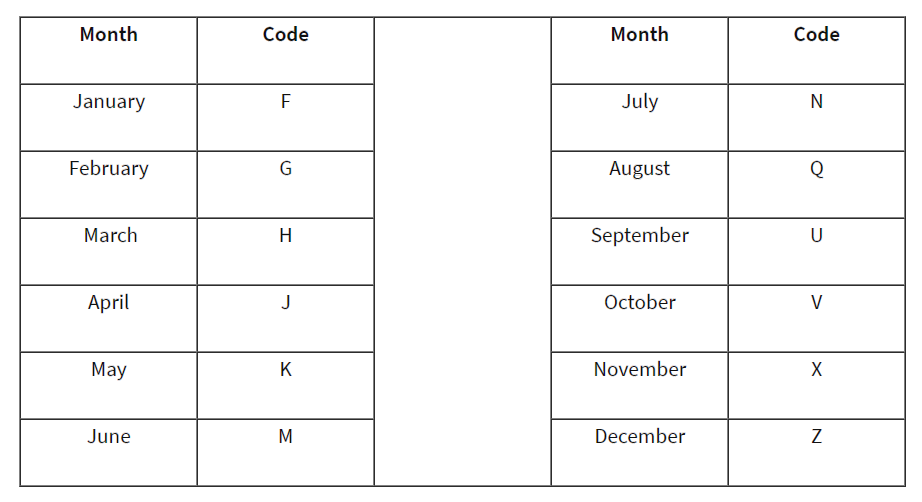

Contract Month & Name

A contract month is the month during which a futures contract expires. Some contracts trade every month, while others trade only certain months of the year. Each contract month is represented by a single letter:

Futures Contract Month Letters

A contract name always includes the ticker symbol, followed by the contract month and two-digit year. For example, the complete contract name for the June 2019 S&P 500 futures contract would be “ESM19”. If you type this into your broker, you need to precede the name with a forward slash, i.e. “/ESM19”.

The Power of Leverage

You might have heard the term “leverage” tossed around from time to time in the stock market. But what does it mean in the context of the stock market? Leverage allows you to enter a futures position that’s worth much more than you are required to pay upfront. For example let’s assume the S&P 500 is trading at 2900. The initial margin deposit is $6,600 per contract at TD Ameritrade at the time of this article being published. The value of the contract is $50 multiplied times the current trading price so $145,000. Buying or selling just the futures contract, you can participate in the moves of S&P 500 index for only ~4.6% of the total cost of the contract. With brokers like AMP, the day trading margin is only $400 so trading is a smaller account (<$5,000) is very achievable.

“Hard stop losses are a must, especially in small accounts.”

However the leverage of futures trading is a double edged sword. While you stand to make a lot of money using a small amount of capital, you stand to loss some or all of your initial capital if you don’t manage your risk according to your risk management plan. Hard stop losses are a must, especially in small accounts.

Geopolitical Landscape

The stock market has a rhythm to how it moves intraday and long term. Each day, week, and month there is some underlying event moving the market. There could be an economic event like Non-Farm Unemployment, ISM Manufacturing, FOMC Minutes or GDP numbers, and/or a news headline like Brexit, a big official being investigated or USA-China trade talks. What happens in other country’s economies matters too.

Most market moves are forward looking meaning if the overall market is optimistic that a USA-China trade deal is near completion, the market could continue to grind higher. Also, the US market could initially react negatively to something like the Turkish Lira selling off, but could recover in the afternoon after market participants realize they overreacted. This is where screen time and consistency pays off.

“Patterns and trends form all the time, but they don’t always last albeit they do repeat themselves.”

You need to stay informed and vigilant at all times. Twitter is a great source for up to seconds information, specifically @zerohedge. Forex Factory also provides an economic data release schedule.

Pay attention and record what the price does based on certain events. Patterns and trends form all the time, but they don’t always last albeit they do repeat themselves. You can give yourself an edge by trading a pattern or trend until it ends or bends.

Global Market Opens, Closes & Economic Data

When trading in the US stock market, it is imperative you know when the markets in China, Japan, Germany and the UK open and close. As well as when any major economic data are being released (GDP, interest rates, and unemployment are just a few to watch).

As mentioned above, typically there are patterns around these times one can use to give their trading an edge. For example, for the last 3-5 days when the China market (HSI) opens, what is the observed price action in the US markets? Note times of the moves, whether HSI was green or red causing the US market to move up or down, etc.

Trading after hours can have lighter volume too. However around the global market opens, closes, and economic data release, volume and price movement tend to increase.

Here is a list of the global market hours for your information in PST. Remember: Forex Factory also lists major economic data releases for all other markets:

Global Stock Market Hours

Know Your Instruments

In the futures market, there are so many instruments to trade. But focusing only on 2-3 instruments and knowing them well is what a wise trader does. Personally I only trade /ES, /NQ and /CL each with their own reasons. Note futures instruments expire every 3 months*.

“...focusing only on 2-3 instruments and knowing them well is what a wise trader does.”

*Do not hold through expiration otherwise you could be assigned the cost to own the contract. Also note, rollover to the next month happens 1 week before the current contract expires.

S&P 500 E-mini (/ES)

The most liquid of all futures contracts, /ES is a great primary instrument to trade. However at times can be choppy which is why it’s nice to have 1-2 other instruments to trade.

Tick value: $12.50 per contract

Nasdaq 1000 (/NQ)

Consists of all the major tech companies in the stock market. I have found that the moves on /NQ are generally bigger than /ES with the majority of the time having a better risk:reward. Price action can also be smoother than /ES, which is also something backtesting my trading bot revealed.

Tick value: $5.00 per contract

Light Sweet Crude Oil (/CL)

Similar to /NQ, /CL also offers some great risk:reward setups. Most of the time I see at least 3-4x the risk. Hard to get that with /ES. Also /CL is very technical. Why does that mean? It means price is very responsive to Fibonacci retracements, and major price levels.

Tick value: $10 per contract

A full list of all the instruments with their risk information (tick value, margin requirement, etc) can be found on CME’s website. Note margin requirements depend on your broker.

Putting it all together

Give yourself at least a month of studying the marketplace and how certain events affect price. You will learn an incredible amount about what makes the market and economy tick. Who knows you might have something interesting to talk about besides the weather or politics with your friends and family.

Create a Trading Plan

So you told yourself you are committed to becoming a successful futures trader, and spent the last month learning about the marketplace. You are feeling ready to jump head first into trading thinking you are going to make all this money…wrong!

Next up you need to create a trading plan. I cannot emphasize this step enough. If you don’t create a trading plan, you are sealing your fate as a trader. DO NOT SKIP THIS STEP.

Make no mistake trading is a business and you need to treat it like one.

What is a trading plan? On a high level a trading plan will prevent you (if you follow it) from losing a lot or all of your money, while keeping your profitability consistent and your draw downs to a minimum. Your plan will keep you from self-sabotaging yourself and your trading account. Major decisions that go into a trading plan include:

Risk Management

Maximum loss per day, week, and month.

Maximum trailing draw down.

Maximum $ risk per trade.

Maximum position size based on account size and risk per trade.

Maximum trades per day.

When to increase or decrease $ risked per trade and position sizing based on account growth.

When you are allowed to trade; some people don’t trade until a minimum of 15 minutes after the market opens so volatility calms down.

Daily profit goal that you will stop trading for the day.

After a losing trade take a 15 minute break to refocus.

No trading 1 minute before and after major economic releases.

“On a high level a trading plan will prevent you (if you follow it) from losing a lot or all of your money, while keeping your profitability consistent and your draw downs to a minimum.”

If possible, I would call your broker and have them set hard limits on your account per your risk management plan. Having hard limits electronically will prevent you from destroying your account because you will be forced to walk away.

Trade Management

Use OCO (One-Cancels-the-Other) order where the first entry order triggers the stop and target.

When to enter a long or short position based on your strategy and/or signal (covered in the following section).

Where to place a stop loss and profit target (this should be known before you enter the market and should try to be at least 1:2 risk:reward).

If the risk on any trade exceeds the maximum allowed per trade or day per your Risk Management plan then Sit on Your Hands (do nothing).

Where and when to move the stop as the trade works or does not work; pay attention to price action.

Psychology Management

Most beginning traders don’t focus on managing their mental state, or psych capital. They quickly realize that trading is mainly mental and that any holy grail strategy that every company is pushing in their ad campaigns will not guarantee success. Trading is simple, but it is not easy.

“...you need to transform in to the person that will help you become successful at trading.”

Like I mentioned at the beginning of this blog post, you need to transform in to the person that will make you successful at trading.

Here are some things to consider in your psychology management plan:

I am allowed to trade:

when I’m feeling optimal physically and mentally.

if I get 7 hours of sleep.

when I’m feeling confident in my analysis.

I am NOT allowed to trade:

when I’m travelling, distracted with another task, from my cell phone, frustrated, stressed out, or angry.

for 15 minutes after a losing trade to avoid revenge trading.

As you start paper trading, focus on following your initial rules to instill positive trading habits that will carry over to real money. Your rules will evolve as your progress as a trader from a technical and mental perspective so always be learning and update your plan.

If you need help creating a trading plan, send me an email. I’d be happy to help!

Find a Broker with a Simulation Account

Next up it’s time to open up a brokerage account that allows you to trade with paper money so you can start becoming familiar with how to input orders, manage trades, study price action and find a profitable strategy. The next section I will suggest some indicators and strategies that you can familiarize yourself with before moving to real money that I highly recommend you backtest with a written plan.

Here are brokers that I recommend that offer a simulation account with fake money. You open up a real account with either of these brokers that you choose when you eventually move to real money:

AMP Global Clearing

Also known as just AMP, they have the lowest day trading margins out there starting at just $400 per contract compared to other brokers that require the full maintenance margin of $5,000+ per contract. Again this leverage is a double-edged sword. When you are paper trading you need to focus on managing risk and not trading in an unrealistic way with large positions and no hard stops. Trade as you would if you were risking real money.

Commissions are one of the lowest in the industry as well costing ~$4 round trip per contract.

“When you are paper trading you need to focus on managing risk and not trading in an unrealistic way with large positions and no hard stops. Trade as you would if you were risking real money”

To get started with AMP, open up a simulation account here.

When you are ready to move to real money, I highly recommend opening up an account with AMP for the low margin requirements and cheap commissions.

TD Ameritrade

I personally use TD Ameritrade in my trading. Not as my broker, but rather for charting and performing technical analysis. If you sign up for a brokerage account with TD, you will receive access to their proprietary trading platform ThinkOrSwim, which in my honest opinion is one of the best charting platforms out there.

Commissions are a bit more for each round trip trade ~$7.00. TD does not offer low day trading margin requirements like AMP does so expect to supply the total maintenance margin requirement per contract on the instrument you decide to trade.

To get started with TD Ameritrade, open up a simulation account here.

TopstepTrader

Another way to paper trade futures is by creating an account with TopstepTrader™. TST offers a 14-day trial to test out their platform and become familiar with their combine that tests your profitability and risk management skills.

The coolest part is that you can earn a fully Funded Account™ without risking your own capital if you pass the Trading Combine®! Look out for my review on TST’s program and how I passed the $30,000 combine in less than 3 weeks to earn a funded account.

To get started with TopstepTrader and receive 20% off your first purchase, click the banner below:

Find a Strategy that Works & Suits Your Trading Style

Notice how I said strategy that works, not just an indicator. A strategy could consist of an indicator or two along with a pattern that you have noticed the last three days into the close, and your willingness to hit the button for example. To be clear, all strategies and indicators work until they don’t. There is no holy grail indicator or strategy that will give you a 100% win rate.

“To be clear, all strategies and indicators work until they don’t.”

Your job as a trader is to manage risk and be consistent in taking the trades when they line up according to your trading plan.

Before we dive into the strategy and indicators I use, it’s important to figure out what type of day trader you are. I consider myself more of a scalper or momentum trader, but able to ride a trend if one presents itself. Do you prefer a higher win rate, but lower average profit per trade? Or wait until the market is trending so you can capture a piece of the move? A lot depends on how much paytience you have as a trader and your personality.

Below are indicators that I use in my day trading strategy(s) and suggest you learn more about:

Fibonnaci Retracements

Fibonacci retracements, or fibs, are a big part of my trading strategy. In a market where ~80% of trading volume is from bots, I have found that fibs are a great tool to identify support, resistance, targets and reversal areas on all timeframes.

Checkout this YouTube video on how I use fibs in my trading, and here is a presentation on fibs I gave with my previous company, PLT.

5 minute chart on QQQ with fibs drawn on opening move

Trend Lines

Trade the trend Trade the trend Trade the trend…got it? Great!

One way to increase the probability of your trades working is to always trade in the direction of the overall trend. As a day trader, you should focus on the 5min, 15min, 30min or 1 hour timeframes. But find what works for you.

“Trading the trend will lower your risk while increasing your reward substantially if the trade works.”

How do you draw trendlines? Simply connect the most recent consecutive highs and lows similar to the picture below. Trading the trend will lower your risk while increasing your reward substantially if the trade works.

Crude Oil trending up.

Pivot Points

Pivots Points are significant levels chartists can use to determine directional movement and potential support/resistance levels. Pivot Points use the prior period's high, low and close to estimate future support and resistance levels. In other words Pivot Points are areas where price could reverse direction.

One type of Pivot Point calculation that I use is the 3-day Pivot. This indicator is great for spotting a spot where price could find support or resistance as shown in the picture below. Note the 3-day Pivot has an upper and lower value. Fibs are also Pivot Points.

3-Day Pivot bounce on AAPL’s 5min chart

Candlesticks, Price Action & Patterns

Price action is king. Being an ultimate avatar of price, price action "indicator" tells me everything I want to know on all timeframes. Reading candlesticks is the method in which one can read the price action based on how a candle closes thus providing insight on which way the next candle will move.

When price is making higher highs and higher lows, that tells me to look for a long trade. When price is making lower highs and lower lows, that tells me to look for a short trade. However, you must be aware if price is approaching a pivot point where a reversal could happen before entering a trade. When price is not making new highs or new lows we call this “chop”, i.e. no direction. Great for scalping, but terrible for a trend trader.

The only way to trade economic events is by reading the price action and being aware of strong pivot points since volatility increases significantly resulting in price whipsawing. Also, patterns often develop and repeat themselves in the market around certain times and events.

“...patterns often develop and repeat themselves in the market around certain times and events”

I will be creating another post covering my favorite candlestick patterns and how I trade them soon. Also explaining the difference between price levels and price action. For now some of my favorite candlestick patterns include a hammer, doji, white soliders, black crows and morning/evening star reversal as you can see in the image below.

Common candlestick patterns.

Screen Time

This one is simple and the most important. You need to put in the time and work to get your eyes and brain accustomed to understanding the market’s rhythm. Sometimes the market does the opposite of what it should, which is where experience from screen time comes in to give you that edge other traders are missing. You will develop an intuition for reading the market, but it will take countless hours and insane dedication on your part.

Other Indicators to Research

I keep it stupid simple in trading which means not using too many indicators. However, I do recommend researching other indicators such as RSI, ADX+DMI, MACD, Volume Profile and moving averages.

Move to Real $ and Take it Slow

This is where most traders sabotage themselves. The confidence is sky high and thoughts of thousands, if not millions, are on the new trader’s mind. This thought process seals the new trader’s fate before the real capital is sent over to their new brokerage account.

Most new traders blow up an account or three within the first 3-6 months of trading with real money. Why is that?

Simple: trading with real money introduces the psychology component of trading. You will not trade the same way as you did with fake money.

Don’t be like 90% of traders that fail to focus on their psychological trading skills (simple, but not easy…I know).

The point of this blog post is to help you approach futures trading the correct way so you can avoid experiencing the pain one feels from a catastrophic loss. I know from experience on three occasions. Losing sucks, but losing your entire account from 2 or 3 losses can make you go fetal and contemplate life because you can’t trade for awhile. The market is unforgiving and doesn’t care you lost all your money.

Mentally it’s very tough to come back to trading after a big loss. The experience plays in the back of your mind for weeks to months preventing you from executing your trades, exiting your winners too early, or worse repeating the same experience.

“Realize that losses are simply the cost of doing business in the stock market.”

Minimum Required Capital

Assuming you open an account up with AMP, the minimum required capital I recommend to start with is at least $3,000. This will cover the $400 margin required for 1 lot as you learn , and give you sufficient room to avoid a margin call if you experience a drawdown at the beginning.

So ease into trading with real money! Stick to your risk, trade and psychology management plans. Remember trading is a long-term game. Focus on 5 years from now. Small wins add up over time as long as you keep your losses to a minimum. You could grow a $3,000 futures account to well over $100,000 in less than 5 years if you manage your risk, and stay disciplined!

Find Mentor(s)

Trading successfully consists of a life-long learning and self-improvement commitment since markets are always changing.

Give yourself another edge: find a mentor(s) that is performing at the level of success you want to be at.

“The goal of finding a mentor, or joining a trading group/community is not to take their trades verbatim. Ask questions, contribute and learn as much as you can while giving back when you start seeing success. ”

Most people think they have to find a single person to help them improve their trading. However there are many ways to find mentors in the trading industry. I list them below with some examples from my experience:

Join a Trading Group or Community

Thanks to the internet, there are so many paid trading groups that you can join. But how do you decipher between the ones that are legit, and the ones that are full of shit? You can check reviews and ask around, but really you either need to take each company up on a free trial, or trust a current or previous patron’s word.

Luckily for you I have had some experience with a few trading groups and communities that I can recommend:

Price Level Trading

Full disclosure: this is my company that I started with my good friend Kristin. Price Level Trading provides affordable and simple trading education to help people use the stock market to make extra money for bills, travel, savings and even become a full-time trader! We focus on fibs, trend, pivots and capital defense management during our live trading room. There is also a private Facebook group and upcoming straight to the point Futures Trading course.

TradePro Academy

I have been following George Papazov and the team at TradePro Academy on Instagram and YouTube for a few months now after being recommended by a colleague. George and his team really know their stuff when it comes to order flow. Look out for their daily morning and afternoon market recaps, and free training courses.

TopstepTrader Facebook Community

The TopstepTrader Facebook community consists of traders of all skills levels from absolute beginners to professionals that trade for a living. Everyone is super supportive! Eddie Horn and the team at TopstepTrader are always keeping members informed on the market. As well as providing tips and insight on how to improve your trading.

Follow Successful Traders on Social Media

Almost every successful and professional trader post frequently on social media. Particularly on Twitter and Instagram. Here are some traders that I follow to gain, or reinforce my knowledge on a daily basis:

Steve Burns

Instagram: @sjosephburns

Twitter: @SJosephBurns

Trader Stewie

Twitter: @traderstewie

Peter Brandt

Twitter: @PeterLBrandt

Chat with Traders

YouTube: @chatwithtraders

Put Yourself Out There

As you progress in trading, you will more often than not find yourself talking about the market or trading to almost everyone you encounter. Majority of people will seem interested about the money part. However eventually you will come across someone that actually is a trader, albeit a successful one. Or they know someone they can connect you with.

The universe is interesting and powerful. Ask and you shall receive is something I fully understand the meaning of over the last two years.

My interest in the stock market and willingness to always be talking about it eventually connected me with one of the best scalpers I have ever seen. Granted I didn’t trade exactly the same way. However I learned a tremendous amount about identifying entries almost to the tick, and how to spot reversals. You just never know people so keep an open mind!

I’m at Your Disposal

You can send me an email, call or text me anytime. I’m here to help you succeed so don’t be shy!

Work Hard, Learn Everyday & Have Fun!

Remember you should always be focusing on the long-term as a trader, learning from your mistakes and enjoying the process every single day! Becoming a successful futures trader is not easy, but it is for damn sure worth it.

Let’s crush it y’all :D.

Let me know in the comments below your experience trading futures so far!