Happy Memorial Day to you and your family!

If you are in the USA's Armed Forces, have served, or know someone that has I would like to take a moment to sincerely thank you both for protecting our beautiful country so that we have the privilege to participate in the stock market on a weekly basis. I am truly grateful on day such as today.

Man did a lot happen last week in the stock market albeit nothing positive for equities between UK's Prime Minister May resigning, US-China trade tensions growing stronger on Trump's call to ban all connections with the Chinese company Huawei, and crude oil selling off over 6%.

In this week's review I will break down last week's action plus what to look for this week in the stock market.

Last Week's Summary

As I mentioned briefly above, the stock market had a rough week mainly due to increased trade war tensions between USA and China. President Trump placed China's leading communications technology solution provider, Huawei, on its Entity List. This means that not only are US firms barred from using its equipment, they are also barred from selling to the Chinese firm – a move that could cripple the company because it relies on Western parts, such as chips. This week I would be watching for China to retaliate against US companies thus putting pressure on the US causing this trade war ping pong to continue indefinitely - or at least until the next election in 2020.

Finally an update on Brexit this past week as Theresa May made her final attempt to gain support for her withdrawal bill failing yet again. With May resigning, the UK took the matter into their own hands to find a new leader. The agreement where the UK would be parting ways with the EU at the end of October 2019 is still in active.

Weaker than expected economic data was released out of Europe as well with talks of the "r" word on an international scale.

Crude oil dropped significantly last week down ~8.2% breaking below its daily 200-day moving average. The sell off was triggered when a significantly larger than expected build with the forecast at -1.2M v.s. actual +4.7M was released on Wednesday's inventory report.

Things to Watch this Week

Economic Data Releases

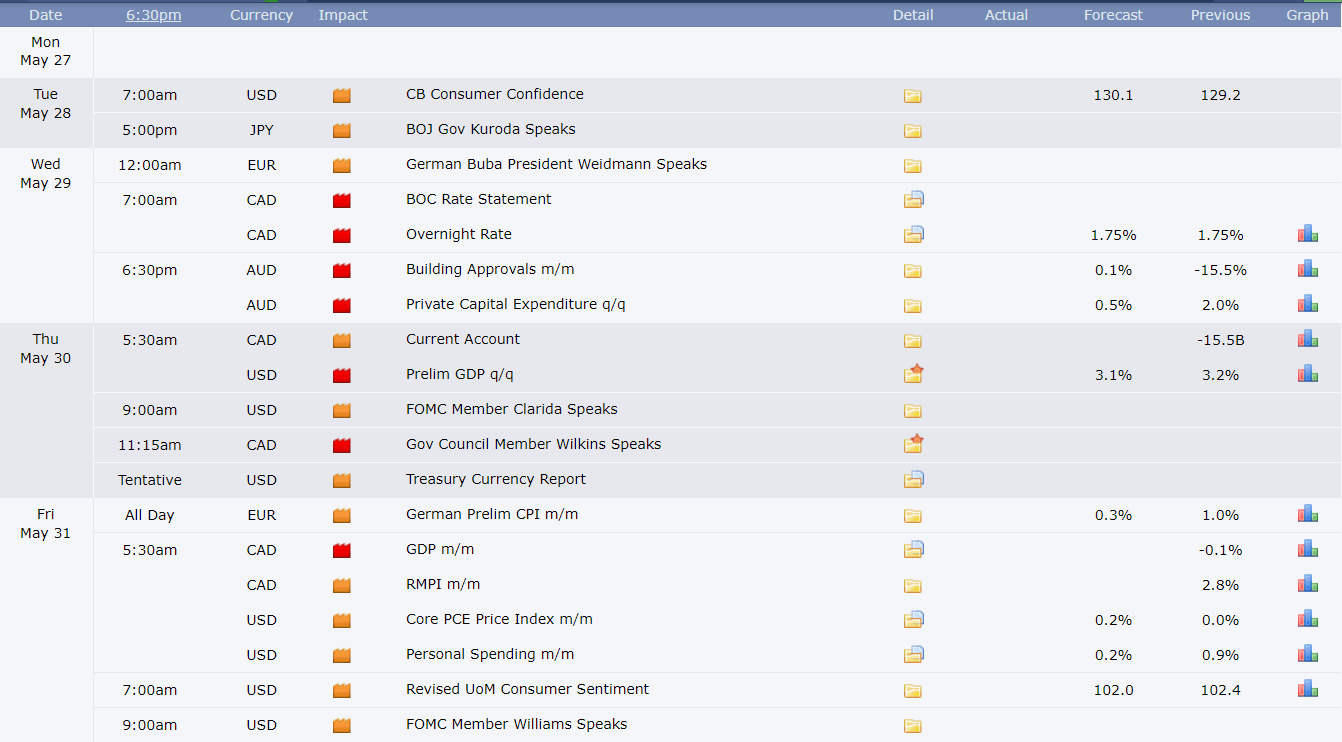

*Note all times in PST; all events are U.S. unless otherwise stated.

As usual crude oil inventories are scheduled on Wednesday at 7:30am PST.

The big economic data release to pay attention to is USA GDP Q1 numbers on Thursday.

Global Trade Tensions Still Dominate

President Donald Trump will continue to hold talks with Japan’s Prime Minister Shinzo Abe early this week amid tensions over differences on trade. Trump is unhappy with Japan's large trade surplus and is considering slapping tariffs on its auto exports if a bilateral trade agreement is not reached.

This Friday, China will increase tariffs on $60 billion in U.S. imports in retaliation for the U.S. decision to hike duties on Chinese imports, escalating a trade war between the world’s two largest economies.

President Trump widened the trade war into a battle over who controls global technology by banning US companies from doing business with China's telecommunication conglomerate Huawei.

*Keep zerohedge, and President Trump's Twitter open at all times. The best way to get notified for all high impact news events is using https://www.tradethenews.com/. Be vigilant y'all.

European Union Election Results

Voting in EU elections wraps up on Sunday and eurosceptic parties are forecast to do well, including in the three biggest countries of the euro zone: Germany, France and Italy.

EU leaders are to hold talks in Brussels on Tuesday to start the process of appointing the next leaders of the EU institutions, including parliamentary, commission and council presidents.

The search for a new European Central Bank president will also be in focus as EU heads meet, with investors keen to see who will succeed Mario Draghi and whether they will emulate his approach to monetary policy.

If you are trading futures overnight during the EU open, be vigilant of any news that surfaces regarding these elections.

US Retail Earnings: COST, DLTR, GPS and ULTA

Stock Buybacks and Macroeconomics

The current 10 year bull market is the longest in history, and a lot of people expect it to continue because why not right? The economy is in "great shape" with the lowest unemployment in 50 years and the stock market just made new all-time highs.

This is actually concerning to me for a few reasons:

1.) An extremely low unemployment rate hints that we may be nearing the end of the current economic cycle. Notice in the graph below around the time the stock market crashed during the 2000 tech bubble and 2008 housing market crash.

How can a low unemployment rate be bad for the economy? Well first let's define what the unemployment rate defines: The unemployment rate is defined as the percentage of workers who are unemployed and actively looking for a job. Another way to phrase this is if you are unemployed, but not actively looking for a job either because you are lazy or lack today's in-demand skills, you will not count in the unemployment number. This has to make you wonder how this number can realistically reflect how many people are actually unemployed.

Something to note is that the growth of the working population is slowing to becoming negative, which means there are less able workers that count towards the unemployment number, and contribute to paying pensions, social security and more.

2.) Retail sales are down year over year in a downtrend:

3.) Tax cuts: we have been fed the spoon that tax cuts will generate investment growth, but have they really? Nope. The investment growth came from numerous stock buybacks, which was a large reason for the stock market to continue as high as it did (of course Trump, JPow and the Plunge Protection Team). Corporate tax cuts only decreased the amount payable, whereas the personal taxes payable is continuing to go higher. If you're an employee that means you can expect to keep paying more taxes under Trump's new "tax cuts".

Is this the end of the longest bull market in history? No one really knows for sure, but I can say that I'm cautiously bullish over the next 3-6 months. I already moved my 401k and other retirement accounts to cash when the market was hitting all-time highs to lock in almost 20% gain for the year. That is a spectacular return in less than 6 months in just the major indices.

Weekly Futures Levels

ES - S&P500

The daily trend is still down since the bulls could not hold the break above 2890 (let's round to 2900), which is a key level that needs to be taken back by the bulls for any upside momentum to be sustained. 2860-65 is major resistance that needs to clear. This level could present a nice short opportunity for the next leg lower middle of next week. If 2865 is taken out on strong volume, the upside targets are the next fibs at 2880 and 2900. 2800 is still a battle ground until it is broken. If that does occur, I expect some temporary support to come in around 2790 back to 2820 before a possible leg down to 2760. Extreme downside target is 2700.

NQ - Nasdaq

Similar to ES, NQ's longerterm structure is bearish in a downtrend. Bulls need to break above and hold 7400 and ultimately break the downtrend to gain strength back to the upside. Lower support levels include 7300, 7200 and 7025. If the bears come out to play, 6925 is a possibility.

YM - Dow Jones Industrial Average

For the bulls to sustain momentum back to the upside, 25,865 needs to broken and held on a retest to have a chance at testing 26,000. Downside price needs to hold 25,500 or a test lower could be in store. Major support at 25,200. If 25,200 is lost, a test of 24,800-24,900 could be in store.

RTY - Russell (small cap)

The RTY is the weakest and typically leads the bigger indices. If the RTY is not increasing in price on strong volume, there's a good chance that smart money is not participating in the rallies except to cover their short positions. 1498-1500 is a very critical level that needs to hold. If this support is lost, a move down to 1455 or 1435 could occur. Bulls need to clear 1535 and 1550 to sustain any momentum back up to test 1562 and 1570 levels.

GC - Gold

Gold is holding strong support at 1270. If US-China trade war continues to escalate, look for gold to grind higher into the 1290 then near the 1300 levels. Seasonality for buying gold tells me that July through September are the best months to purchase gold so I would love to see a pull back to the 200 day sma around 1260. Price is still in a down channel so be paytient for direction.

CL - Crude Oil

Crude oil sold off over 8% last week due to much larger than expected supply on Wednesday's inventory report. If the lows on Thursday and Friday don't hold, it's highly likely crude could be heading to 54-55 per barrel. The support after that I have is ~52. I wouldn't be surprised if crude tested 60-60.50 first though just pay attention to that price action and developing news.

Enjoy the rest of the weekend, and have a wonderful green week trading!